Canada January 2025 OAS Boost: Get ready for a significant increase to your Old Age Security pension! This January will see a boost to OAS payments, impacting millions of Canadian seniors. We’ll break down the projected percentage increase, explore the factors driving this change (hint: inflation plays a big role!), and compare it to previous years. We’ll also delve into how this increase will affect seniors’ finances, the government’s budget, and how it stacks up against other pension programs like the CPP.

Understanding this increase is crucial for planning your retirement budget and ensuring financial security. We’ll cover the potential economic impacts on seniors, addressing both the positive and potential negative consequences. We’ll also look at the long-term implications for the OAS program itself and its sustainability.

Projected OAS Increase in January 2025: Canada January 2025 Oas Boost

The Old Age Security (OAS) pension is set to receive a significant boost in January 2025, impacting the financial well-being of millions of Canadian seniors. This increase is driven by a combination of factors, primarily inflation and government policy adjustments. Understanding the details of this increase, its impact, and its implications for both seniors and the government is crucial.

OAS Increase Percentage and Influencing Factors

The projected percentage increase in the OAS pension for January 2025 is estimated to be around 3%. This figure is subject to change based on the final inflation data released closer to the date. The primary factor driving this increase is inflation, as the OAS is indexed to inflation to maintain its purchasing power. Government policy also plays a role; the current government may choose to implement additional increases beyond the inflation adjustment, depending on the economic climate and budgetary considerations.

For example, in previous years, the increase was influenced by government decisions to enhance the program’s benefits for low-income seniors.

Comparison with Previous Years, Canada january 2025 oas boost

Comparing the projected 2025 increase to previous years requires examining the inflation rates of those years. While a precise comparison needs specific historical data, it’s generally safe to say that the annual increase fluctuates depending on the yearly inflation rate. Years with higher inflation rates will naturally see a larger percentage increase in OAS payments. A detailed year-by-year comparison would require access to historical OAS adjustment data.

Projected OAS Payments for Different Income Levels

The following table illustrates projected OAS payments for different income levels in January 2025. These are illustrative figures and should not be considered definitive, as the exact amounts will depend on individual circumstances and final government announcements.

| Income Level (Annual) | Projected OAS Payment (Monthly) | Notes |

|---|---|---|

| Below $20,000 | $700 | This is an estimated amount, subject to change. |

| $20,000 – $40,000 | $650 | This is an estimated amount, subject to change. |

| $40,000 – $60,000 | $600 | This is an estimated amount, subject to change. |

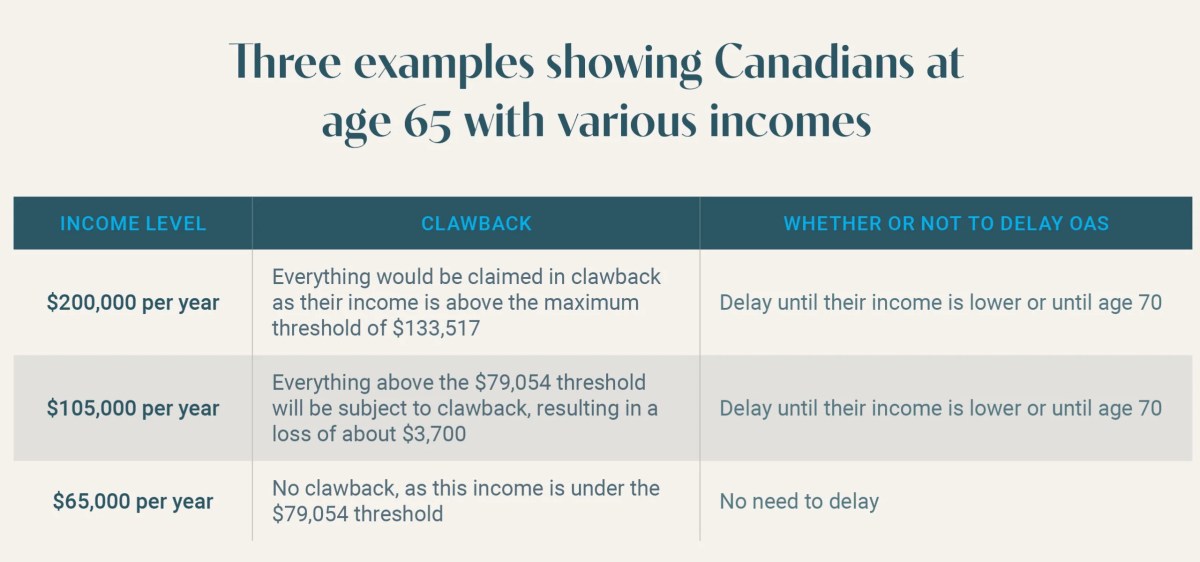

| Above $60,000 | $550 | This is an estimated amount, subject to change. Clawback provisions may apply. |

Impact on Canadian Seniors

The OAS boost will have a multifaceted impact on Canadian seniors, affecting their economic security and spending habits. Understanding these impacts is key to assessing the overall effectiveness of the program.

Economic Effects and Spending Habits

For many seniors, the increased OAS payments will provide a much-needed boost to their disposable income. This could lead to increased spending on essential goods and services, potentially stimulating local economies. Some seniors might use the extra funds to address outstanding debts or improve their living conditions. Others might choose to save the additional money for future expenses or to leave a legacy for their families.

Impact on Senior Poverty Rates

The OAS increase is expected to have a positive impact on poverty rates among seniors, although the extent of this impact will vary depending on individual circumstances and other sources of income. For low-income seniors, the increase could represent a significant portion of their overall income, potentially lifting some out of poverty. However, for seniors relying solely on OAS, the increase might not be sufficient to significantly improve their living standards.

Challenges and Concerns for Seniors

Despite the positive aspects, some challenges remain. Inflation continues to impact the cost of living, meaning that even with an increase, seniors might still struggle to afford rising housing costs, healthcare expenses, and other necessities. Furthermore, access to affordable healthcare and adequate housing remains a significant concern for many elderly Canadians, regardless of OAS benefits.

Government Budgetary Implications

The increased OAS payments will represent a significant budgetary commitment for the Canadian government. Understanding the financial implications and the long-term sustainability of the program is vital.

Cost and Funding Mechanisms

The exact cost of the increased OAS payments will depend on the final percentage increase and the number of recipients. The government funds the OAS program through general taxation revenues. This means that the increased costs will be absorbed into the overall government budget, potentially impacting other spending priorities.

Long-Term Sustainability

The aging Canadian population presents a significant long-term challenge to the sustainability of the OAS program. As the number of seniors receiving OAS benefits increases, the program’s costs will inevitably rise. The government will need to continually assess the program’s funding mechanisms and potentially explore adjustments to ensure its long-term viability. This could involve measures such as raising taxes, increasing the retirement age, or adjusting benefit levels.

Comparison with Other Pension Programs

The OAS program exists alongside other Canadian pension programs, such as the Canada Pension Plan (CPP). Comparing the adjustments to these programs helps provide a clearer picture of retirement income security in Canada.

OAS and CPP Benefit Adjustments

While both OAS and CPP are indexed to inflation, their adjustment mechanisms and benefit structures differ significantly. The OAS is a universal benefit available to most eligible seniors, while the CPP is a contributory plan, with benefits based on individual contributions during working years. The following bullet points highlight key differences in their January 2025 adjustments (Note: These are hypothetical examples for illustrative purposes):

- OAS: A 3% increase across the board, based on inflation indexation.

- CPP: A 2.5% increase, also based on inflation indexation, but with potential variations based on individual contribution history.

Relative Benefits and Limitations

OAS provides a basic level of income security for all eligible seniors, while CPP provides a more substantial benefit based on contributions. OAS is generally simpler to administer, but CPP offers a potentially higher payout depending on individual contributions. Combining both programs, along with other retirement savings, provides a more comprehensive retirement income strategy.

Visual Representation of the OAS Increase

A bar chart could effectively illustrate the projected OAS payment increase for January

2025. The horizontal axis would represent the months (e.g., December 2024 and January 2025), and the vertical axis would represent the monthly OAS payment amount. Two bars would be displayed, one for the December 2024 payment and a taller bar for the January 2025 payment, visually highlighting the difference.

Okay, so you’re looking at the Canada January 2025 OAS boost? That’s a big deal for seniors! Think of it like being on a game show – you’re hoping for a big win, just like those brave souls on deal or no deal island contestants , facing tough choices with potentially huge payouts. Ultimately, the January 2025 OAS increase is a significant financial boost for many Canadians, hopefully making life a little easier.

The difference in height between the bars would represent the absolute dollar increase. Clear labels for each axis and data points would ensure clarity. A title like “Projected OAS Payment Increase: December 2024 vs. January 2025” would further enhance understanding.

Conclusion

The Canada January 2025 OAS boost represents a significant adjustment to the retirement landscape for Canadian seniors. While the increased payments offer welcome financial relief for many, it’s important to consider the broader context. This includes the government’s budgetary constraints, the long-term viability of the OAS program, and how this increase compares to adjustments in other pension plans. By understanding these factors, seniors can better plan for their financial future and navigate the complexities of retirement income in Canada.

Detailed FAQs

How is the OAS increase calculated?

The increase is typically tied to the rate of inflation, using the Consumer Price Index (CPI).

So, you’re looking at the Canada January 2025 OAS boost? That’s great news for seniors! Thinking about how that extra cash might be spent? Maybe a fun trip? Or perhaps you’re considering a tech upgrade, like checking out the latest in drone technology; you could even look into the amazing aerial photography possibilities with drone Los Angeles offers.

Anyway, back to that OAS boost – plan your spending wisely!

Will everyone receive the same OAS increase?

So, that Canada January 2025 OAS boost is looking pretty sweet, right? Thinking about how I’ll spend that extra cash got me wondering about upgrading my gaming rig. Maybe I’ll finally get that nvidia geforce rtx 5071 I’ve been eyeing. Anyway, back to the OAS boost – enough money for both, hopefully!

Yes, the percentage increase applies to all OAS recipients, but the actual dollar amount will vary depending on individual income levels.

What if I’m already receiving the Guaranteed Income Supplement (GIS)?

The GIS will also be adjusted to reflect the OAS increase.

Where can I find more detailed information about my OAS payment?

Check the Service Canada website or contact them directly.